“This [the Stalingrad Strategy] is a strategy of wearing down the plaintiff by tenaciously fighting anything the plaintiff presents by whatever means possible and appealing every ruling favourable to the plaintiff. Here, the defendant does not present a meritorious case. This tactic or strategy is named for the Russian city besieged by the Germans in World War II.” (Judges Matter website)

Divorce disputes are of course intensely personal and emotionally charged affairs — and when feelings run high the resultant fallout can mean protracted, bitter, and costly litigation.

If you are being subjected to a barrage of such litigation, take heart. In balancing our constitutional right to access the courts against the need to prevent people from abusing court processes with endless and meritless litigation, our law provides for “vexatious litigants” to be stopped dead in their tracks.

A recent pair of High Court decisions (featuring the same parties and the same divorce dispute, but in two different battles) provides a textbook example.

A saga of litigation, complaints, threats, and blackmail

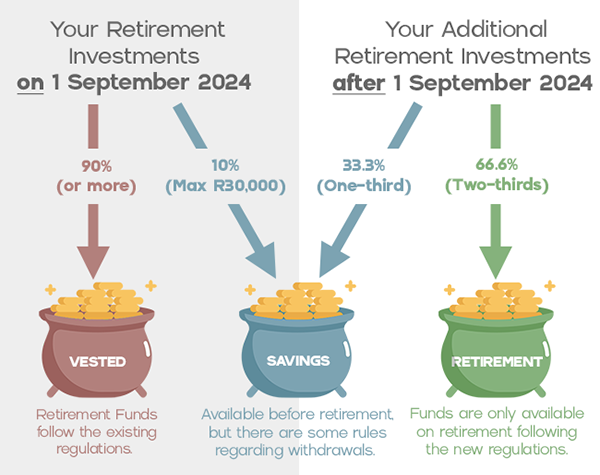

This 11-year saga dates from the start of divorce proceedings in 2014, with the financial aspects of the divorce being finalised only in 2020. The ex-wife was awarded a total of R16.8m in accrual, maintenance, and costs. The ex-husband’s property-owning trust was held to be his alter ego, and that opened the door for the house held by the trust (a valuable property in an upmarket Cape Town golf estate) to be sold as his asset.

He responded with a concerted campaign of unrelenting litigation, complaints, and threats — all aimed, the Courts have now determined, at overturning the divorce order.

The list of his serial litigation and intimidation tactics is both long and extraordinary, but suffice it to say that a flood of applications of all sorts to a wide variety of courts (all the way up to the Constitutional Court) is just the tip of the iceberg. He has also lodged professional complaints against all the attorneys and advocates involved in this matter (including his own legal team) and against the Divorce Court Judge. Not even his own financial expert escaped a formal complaint. Allegations of perjury, fraud and collusion abound. He has threatened massive lawsuits (for R210m and R190m to date) against various legal representatives. He was even found to have resorted to blackmail.

Neither his singular failure to reap anything but defeat from any of these endeavours (barring a few minor skirmish successes, and noting that some of the more recent matters remain pending), nor the slew of costs orders made against him (at least one of them on the punitive attorney and client scale), seem to have deterred him in the slightest.

His latest rearguard action, a failed attempt to postpone the auction sale of his house, has earned him yet another defeat and another costs order, with the cherry on top being his being declared a “vexatious litigant”. He can now no longer launch legal proceedings without specific High Court authority to do so.

All’s fair in love and lawfare? Not so fast

As the Court put it: “A fundamental doctrine in our law is, there must be an end to litigation … nobody should be permitted to harass another with second litigation on the same subject as such litigation can be viewed as an abuse of process.” Our courts accordingly have the power to declare such a person a “vexatious litigant”, thus restricting them from launching any new legal proceedings without specific court authority.

To have your opponent declared vexatious, you will need to prove that the person “has persistently and without any reasonable ground instituted legal proceedings in any court or in any inferior court, whether against the same person or against different persons.” There are two legs to that, and note that you can’t stop anyone from pursuing normal appeal and review processes — there must be some abuse of judicial process.

You may also be able to get an order that your opponent provide security for your costs. Although, in this particular matter, the ex-wife was unable to convince the Court to grant her such an order.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact us for specific and detailed advice.

© LawDotNews